This post is also available in: עברית (Hebrew) Русский (Russian) العربية (Arabic)

CWS Israel Corporate Debit Card

Simplify Employee Expenses with CWS Israel’s VISA Corporate Debit Card

What is a Corporate Debit Card?

A corporate debit card is a payment card given to employees by their company. It allows them to pay for business expenses or withdraw money directly from the company’s account. The company can set spending limits and control how much employees can spend, helping to manage expenses easily.

How is it Different from a Credit Card?

A corporate debit card uses money that is already in the company’s bank account. There is no borrowing involved, and you don’t have to worry about paying interest. On the other hand, a credit card lets you borrow money up to a limit, and if you don’t pay it back on time, you’ll be charged interest.

With a debit card, you spend only what’s available, making it a safer and more controlled option for managing employee expenses.

Why Choose CWS Israel’s Corporate Debit Card?

Accepted in 60+ countries

spend anywhere VISA is accepted

Branded to your business

include your logo and employee names

Full control & transparency

set spending limits, monitor transactions.

Mobile-ready

Apple Pay & Google Pay integration.

No reimbursement delays

employees never use their own money.

Maximize Efficiency and Cut Costs with Employee Expense Management

Managing employee expenses can be a time-consuming and complex process, but with CWS Israel’s Corporate Debit Cards, businesses can streamline and simplify this task. Here’s how our prepaid corporate cards can help you maximize efficiency and cut costs:

Streamline Employee Spending

One of the biggest challenges for businesses is managing employee reimbursements. Employees often have to cover their own expenses upfront, leading to delays and complications in reimbursement processes. With CWS Israel’s employee expense cards, this issue is eliminated. Preloaded with specific budgets, employees can make purchases within authorised spending limits without needing to use their own funds. This saves time for both employees and the finance team and reduces the administrative burden of processing reimbursements.

Reduce Employee Tax Liabilities

In certain arrangements, such as the Employer of Record (EOR) setup in Israel, expense reimbursements are considered a taxable benefit for employees, which increases both the employer's and employee's tax burdens. This is a common scenario for companies using EOR services in Israel, where proper handling of expenses can lead to significant tax savings.

By using an international employee expense card, businesses can bypass this taxable benefit. This results in lower taxes for both parties, helping to reduce costs for the employer and lowering the employee’s taxable income. The use of prepaid corporate cards helps ensure that all expenses are clearly defined and controlled, without triggering additional tax liabilities.

Designed for Employee Convenience

& Managerial Oversight

For Employees

No out-of-pocket expenses

company funds everything upfront.

Easy online & in-store payments

use globally

Access via mobile app

full transparency

For Managers

Set & control budgets

define spend limits per employee/vendor

No reimbursement admin

reduce finance headaches

Ensure compliance

built to meet Israeli legal & tax regulations

How It Works: Simple 3-Step Setup

Managing business expenses has never been easier. With just three simple steps, you can start using CWS Israel’s corporate debit cards and take full control of your company’s spending.

01

Register for the CWS Israel Corporate Debit Card Program

Sign up for the programme by providing your business details. Our team will guide you through the registration process to make sure everything is set up correctly and smoothly.

02

Activate Your Custom-Branded VISA Cards

Once registered, you’ll receive your corporate debit cards. You can personalise them and even add employee names for easy identification. Simply activate the cards, and they’re ready to use.

03

Fund the Card and Start Hassle-Free Spending

Load the desired amount of funds onto each card based on your business needs. Employees can then start using the cards for approved business expenses, with full control and visibility over every transaction.

With this simple setup, you can quickly provide your team with a secure, efficient, and easy way to handle company expenses.

Save on Taxes with International Employee Expense Cards in Israel

In Israel, reimbursing employees for work-related expenses is often considered a taxable benefit. This means that when a company pays an employee back for things like travel, meals, or supplies, the amount is treated as extra income—and taxed accordingly at the employee’s personal income tax rate. This can significantly increase costs for both the employer and the employee.

Using an international employee expense card from CWS Israel helps avoid this issue. Instead of reimbursing employees after they spend their own money, you provide them with a prepaid corporate debit card that’s loaded with funds in advance. Because the company controls and tracks the spending directly, it’s no longer considered a taxable benefit to the employee.

This approach offers a clear advantage:

- For Employers: Reduced payroll tax costs and simplified expense management.

- For Employees: Lower taxable income and no need to use personal funds for work-related expenses.

By switching to international prepaid expense cards, businesses in Israel can stay compliant, cut unnecessary tax burdens, and make expense management fairer and more efficient for everyone involved.

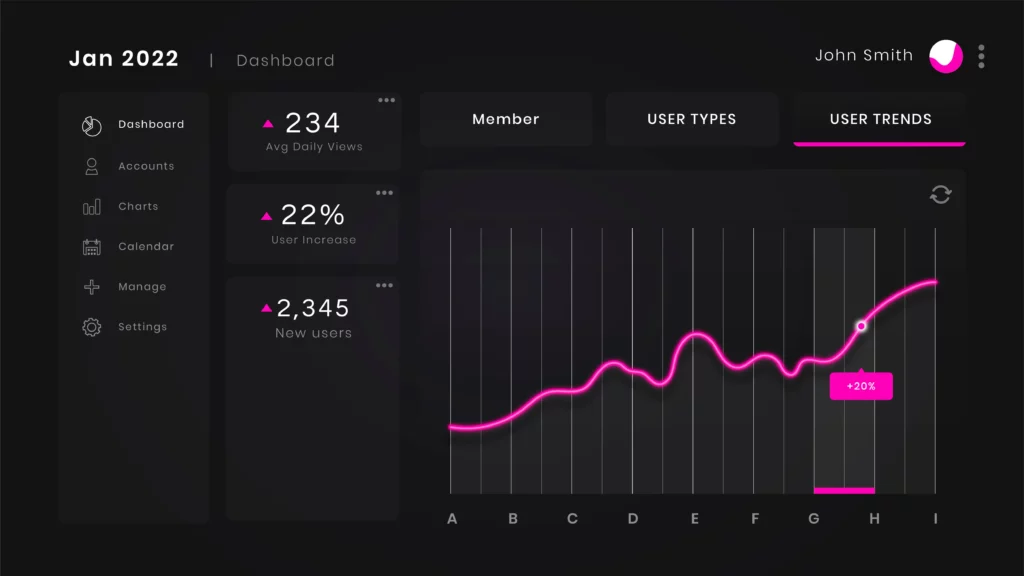

Total Visibility Over Every Transaction

- Track spending in real-time via a secure online portal.

- Set vendor-specific restrictions – control how & where money is spent.

- Access full reports for compliance & financial planning.

Trusted by Businesses, Loved by Employees

Industry Leaders

Is This The Right Expense Solution for You?

Because it eliminates the delays & admin of reimbursement-based systems, saves on taxes and much easier to use and manage.

No! Whether you have 1 or 100 employees, this solution scales with you.

Prepaid, controlled spending – no risk of unexpected debt. In addition, Corporate Credit Cards are linked to the company’s account, which makes the application process much longer and more complicated. Using a Corporate Debit Card simplifies the process and approval time.

A corporate debit card is a business-issued payment card that allows employees to make purchases or withdraw funds directly from the company’s account, with spending limits and controls in place.

Unlike credit cards, corporate debit cards use preloaded or available funds from your business bank account, which means there’s no borrowing or interest involved.

International employee expense cards are ideal for businesses with remote teams, frequent travellers, or overseas branches. They help avoid currency conversion issues and offer greater control over foreign spending.

In an EOR arrangement in Israel, expense reimbursement is considered a benefit, and therefore it is taxed at the Employee’s tax rate. using an international expense card bypasses that benefit, and thus reduces the Employer costs, and the employee’s taxable income.

Employee expense cards are assigned to staff members and preloaded with specific budgets. Employees can use them for authorised purchases, and the company can track all expenses in real time.

Take Control of Your Business Expenses Today

Empower your team & simplify financial management with CWS Israel’s Corporate Debit Card.

This post is also available in: עברית (Hebrew) Русский (Russian) العربية (Arabic)